Death, Debt and Demography – property peril

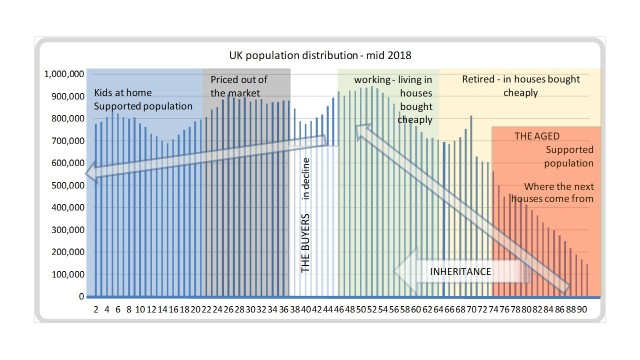

If everybody in the U.K. was made to stand in line according to age they would make a giant bar graph like this. Your place is there too; as you grow older each year your own line takes a sideways step to the right, and so does everyone else’s.

The steep ramp down to zero starts earlier than you would expect, from as young as the mid fifties. This is due to population growth (fewer people were born in the past so the corresponding lines are smaller) and also early death. You don’t have to wait for old age to join the 542,000 deaths each year; over 300,000 die from cancer, dementia, heart and stroke, all of which can strike prematurely.

The chart illustrates how demand from an ever increasing population made the meteoric rise in house prices inevitable. Look at the biggest and tallest block on the chart – the sixties baby boomers. The biggest population surge ever seen, grew up, got jobs and bought houses as fast as they could be built. Easy access to cheap money accompanied the latter days of the surge so it was inevitable that the run in prices would continue into territory that now looks uncomfortably overbought. That is just the nature of markets.

Once the rush started a new ‘truth’ emerged. With prices perpetually rising, for many borrowers there was no question of repaying their interest only loans; they could always sell at a profit, pay off the debt, buy a car and live happily ever after. This sort of thinking actually worked when prices kept rising; even the lenders got sucked in as their loans appeared to be safe. Old habits die hard it seems but what happens to those loans in a stagnant or falling market? Debt is a deferred payment which has to be paid by someone. Could it be that current buyers are not fully aware that they will have to pay back every penny? Now those mad days are over some recent house purchases may never be paid for, much to the chagrin of the lenders. An unfortunate knock-on from this mistaken optimism is that it inevitably depletes the inheritance tally of the next generation and their ability to buy a house.

Today the bulk of the boomers are middle aged, employed and at the height of their earning power, they mostly bought their houses cheaply and have seen their equity rise enough to borrow against it. There is a smart car on the driveway (brand new for one in ten households), holidays, restaurants, life is good. The bounty doesn’t stop there though, their parents are dying, a house is inherited to be sold or rented out. If only life could be so easy for everyone. The chart says no.

After the peak of the boomers the birth rate started to decline, 13 years in a row, and that signaled the end of their powerful influence on property prices and a lot more besides. The big arrow on the left of the chart shows the annual birth tally in gentle decline for the last 50 years. For now, births still exceed deaths so the population is still growing but births initially make more expense for the very group that is already struggling with high house prices.

The arrival of the baby boomers caused some seismic but positive effects and now, as they start to retire, we can expect to see some negativity as those effects are reversed. More people will retire for each of the next fourteen years until half the current block of baby boomers is drawing pensions with the other half still to go. From 2020 on, retirees start to overwhelm the young earners (backward slope in their area) coming up behind them.

The chart has an even bigger story to tell. Note the two big arrows on the chart and the abrupt change in direction just where the baby boomers peak occurs some 50 years ago. This is a momentous event not seen before for centuries; it signals the end of population growth and the start of a new ex-growth era. The effects of this will be profound, affecting pensions, business, stock valuations and more. As the change takes place the money – that washed plentifully over industries like travel, baby goods, retail, house builders and automotive – is drying up, with results that have recently been all too obvious. Sector by sector is succumbing to a lack of cash. The change is well under way with a lot more to come. House prices will be next. Ironically, as the wealthy baby boomers decrease their spending the resulting job loses are born by the next generation and job uncertainty holds back house buying decisions.

The Government will have to fund all the extra draws on the NHS, pensions, debt funding etc. by increasing taxes or borrowing more. But with the number of tax payers declining the Government will have to sell more bonds and this at a time when pension funds become net sellers of bonds (to pay out the pensions of course). With fewer buyers for bonds the only way to make them more attractive is to raise yields and this devalues existing bonds so even more have to be sold to pay the pensions. This is just one example of how ex-growth U.K. faces some intractable vicious circles. The point though is that this puts upward pressure on interest rates. The bank base rate is now 0.75% so there is very little scope for a fall so when change does come it is likely to be bad for property prices.

Excess personal debt is a major threat to property prices. On the surface daily life looks normal and secure but in reality it’s artificially and precariously propped by debt. We’re flying by pulling on our bootlaces. Whether through poverty or imagined wellbeing, personal debt continues to grow. Average household credit card debt is now £2,603 – pretty astonishing for the average. It seems unlikely that anyone needing this much debt can pay it back very quickly and it is predicted that the figure will increase substantially in the next 4 years. Average adult debt for everything including mortgages is £59,823. With record debt there is hardly a wall of money heading towards the property market.

Then there is government debt. As the retirees swell to well over 17 million that produces an annual pensions demand of around £170 billion not including the extra demand on the health service. The pensions industry and the Government need to be ready for this. The former already have their prudence being tested (or exposed) by the ex growth phenomenon but the problem for the Government is more acute. Pensions have always been met by the expanding set of workers following behind; a system that always worked when earners were growing in number. After centuries of habit forming complacency that era is now over. The new paradigm must involve extra taxes and borrowing. In contrast to the private pension system there is no Government pension pot, just borrowings of over £1,800,000,000,000 which is £56,000 per taxpayer and nearer £75,000 when future pension obligations are added (a promise to pay in the future is a debt). With talk of ‘fiscal headroom’ and post Brexit expenses looming these totals will certainly increase. There is talk about the end of posterity but that’s a word we can expect to see again.

The property boom has divided society into two halves. The people on the right half of the chart live in houses bought cheaply and they are very well off. All the people on the left don’t have a house and can only ever buy an expensive one; after rent, rates, general living expenses these are the people with credit card debts instead of savings.

Take the younger group shown in grey; they are starting out on their careers with little chance of buying a house of their own except via inheritance or parental gifts. The national house price to earnings ratio might be at a peaky 6 but that’s an average. Take a typical cookie cutter house in the south of England for £450,000 and the average wage of £26,364 and the ratio is 17; totally unsustainable, especially as hopeful buyers trapped in expensive rental properties are more likely to be in debt rather than building a savings pot. Let’s be clear about house price to earnings ratios; if the ratio is 17 then it would take ALL your earnings over 17 years to pay for it, and that’s before interest. Potential buyers for houses at the current prices are not in this grey group.

Obviously there are buyers out there, not very many though and declining by the year, but there non-the-less. In the home counties in particular properties are being bought by new millionaire Londoners cashing in before prices retreat further.

And buying still makes sense right? The agents saw high demand for these high priced houses which were sold quickly too – business was booming. Hold on, hold on; that’s the first danger sign slipping by – high turnover. Turnover so high that your local high street can support several estate agents (but no banks) – something weird there. When there are too many buyers or too many sellers there is an imbalance and transactions are relatively low. When there is a transition from one state to another there is a period when sellers exactly match the buyers; perfect conditions for a peak in transactions and peak agents. Logically, when transaction volume is high the market is turning. What looks like a buying frenzy is actually a subtle warning sign. The bubble is about to burst. Is that now? The house builders, are no longer making hay – maybe change is in the air?

A market correction has never amounted to much before and setbacks have always been ironed out over time. You can’t go wrong in bricks and mortar can you? Well things might be different this time. At this point we hear the call ‘there is a massive property shortage so prices can’t possibly fall’. Actually there is a shortage of ‘affordable’ property, but there is no shortage at all of ridiculously expensive properties, the market is flooded with them. You might note how half of them have price reductions; they are not exactly being snapped up.

It would be no surprise if Brexit goes down in history as the trigger that turned the property market and burst some other bubbles too. The transition will certainly be disruptive in the short term. There are thousands of areas where there will be a threat to jobs and in turn a threat to property prices.

Watch the pound carefully while Brexit unravels. Any need to defend a weak currency could raise interest rates and that will make holding or buying property even more expensive. Actually it makes everything more expensive; a country with a huge debt burden can only expect huge interest burdens when rates rise.

It can’t be sensible to be invested in an overvalued asset class while all this is going on. Buy-to-let investors (already taxed and stamped) are reasonably liquid and might well see the sense in locking in profits right now. Any obvious downturn in the market will set them selling and after that most buyers will step back to watch the fall.

So, to summarise; property prices are unsustainably high, the money that bought them was easy and cheap but is now evaporating. The ex-growth G.B. effect has kicked in disturbingly early with still more jobs at risk. The market may be turning now, or very soon, and when it does the fall will be sudden and without respite. Bubbles don’t burst quietly.

Follow up March 2020: Well there we are; the pin to burst the bubble has arrived and all sorts of unexpected consequences are popping up. One yet to be seen is the effect on the lenders as their clients lose their jobs and maybe even their lives. In short they have lent on overpriced collateral to clients who can’t pay them back. A black hole in the accounts will decrease the funds to be lent. If turning off the money tap doesn’t trouble the property market I’d be very surprised.